IRS Forms: What You Need to Know

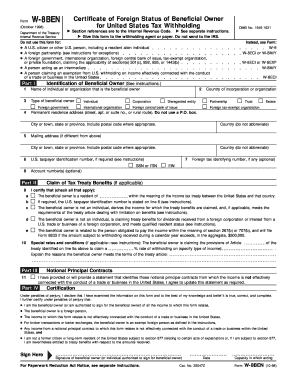

Form W-8: Instructions & Information about IRS Tax Form W-8

When it comes to taxes, understanding the various forms is crucial. One such form is the W-8, which is issued by the Internal Revenue Service (IRS) in the United States. The W-8 form is specifically designed for non-resident aliens, foreign individuals, and entities who are subject to certain tax withholding requirements.

When it comes to taxes, understanding the various forms is crucial. One such form is the W-8, which is issued by the Internal Revenue Service (IRS) in the United States. The W-8 form is specifically designed for non-resident aliens, foreign individuals, and entities who are subject to certain tax withholding requirements.

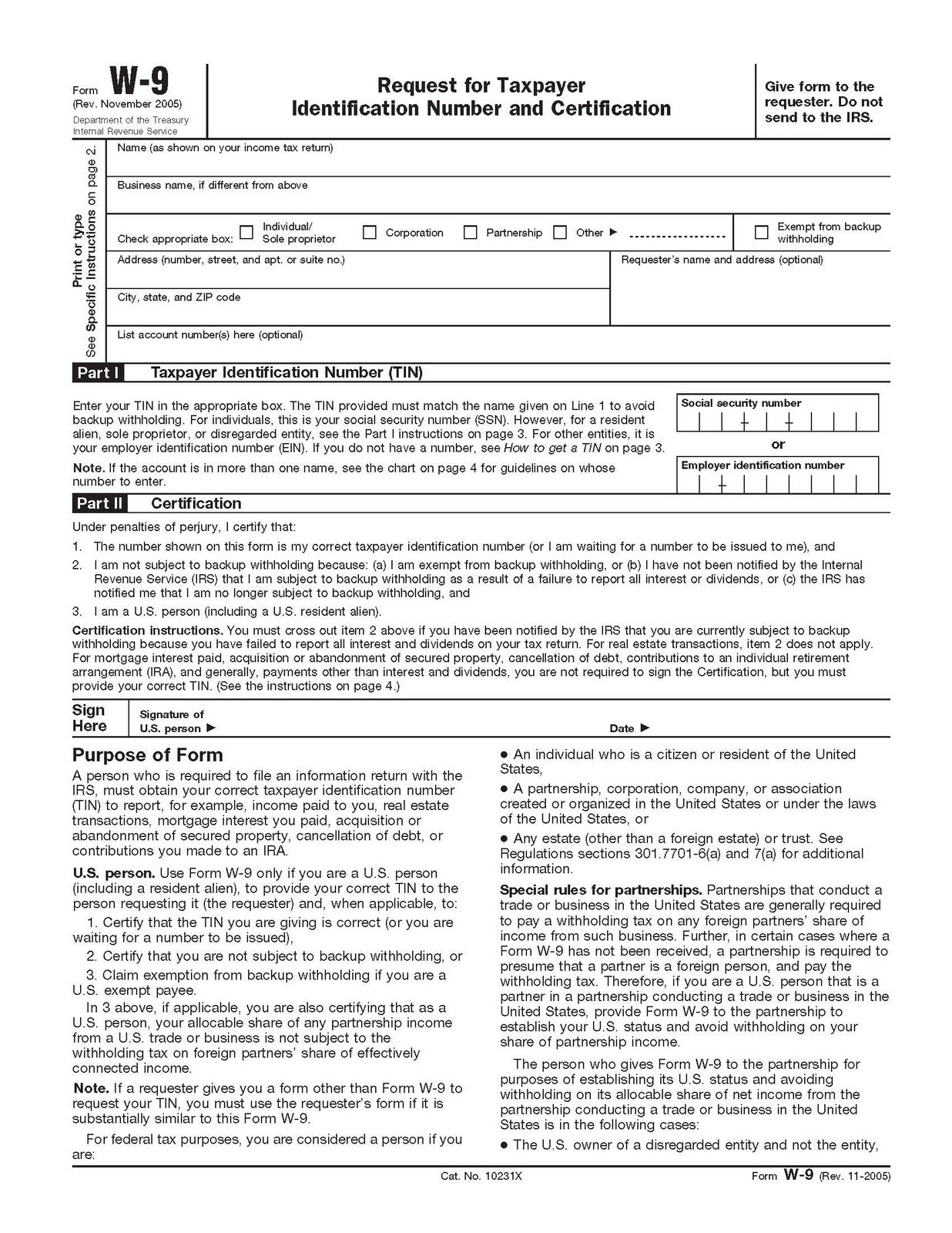

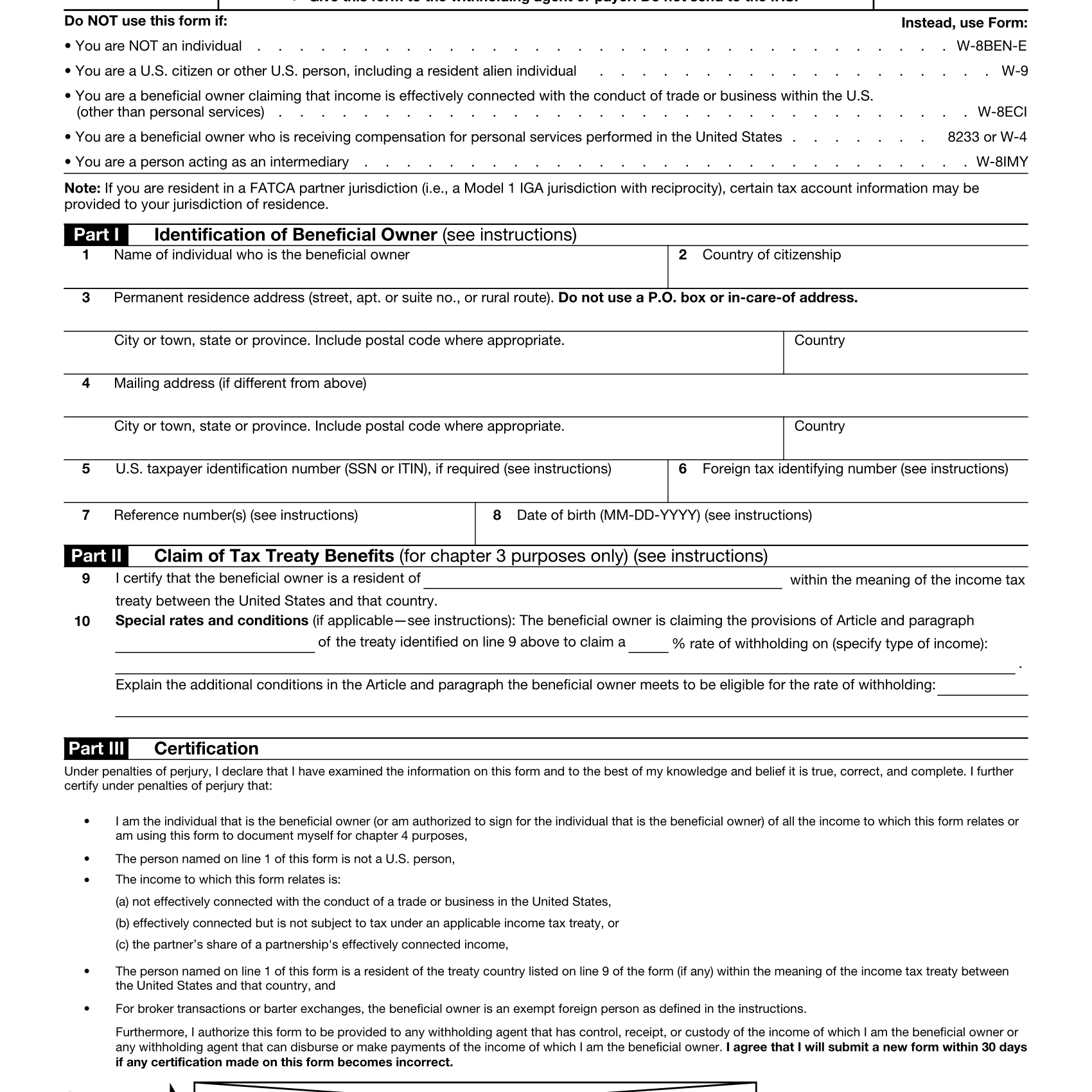

Print Blank W9 Form | Calendar Template Printable

On the other hand, if you are a U.S. citizen or resident alien, you will most likely need to fill out a W-9 form. The W-9 form is used to provide your taxpayer identification number (TIN) to the entities that are required to file an information return with the IRS.

On the other hand, if you are a U.S. citizen or resident alien, you will most likely need to fill out a W-9 form. The W-9 form is used to provide your taxpayer identification number (TIN) to the entities that are required to file an information return with the IRS.

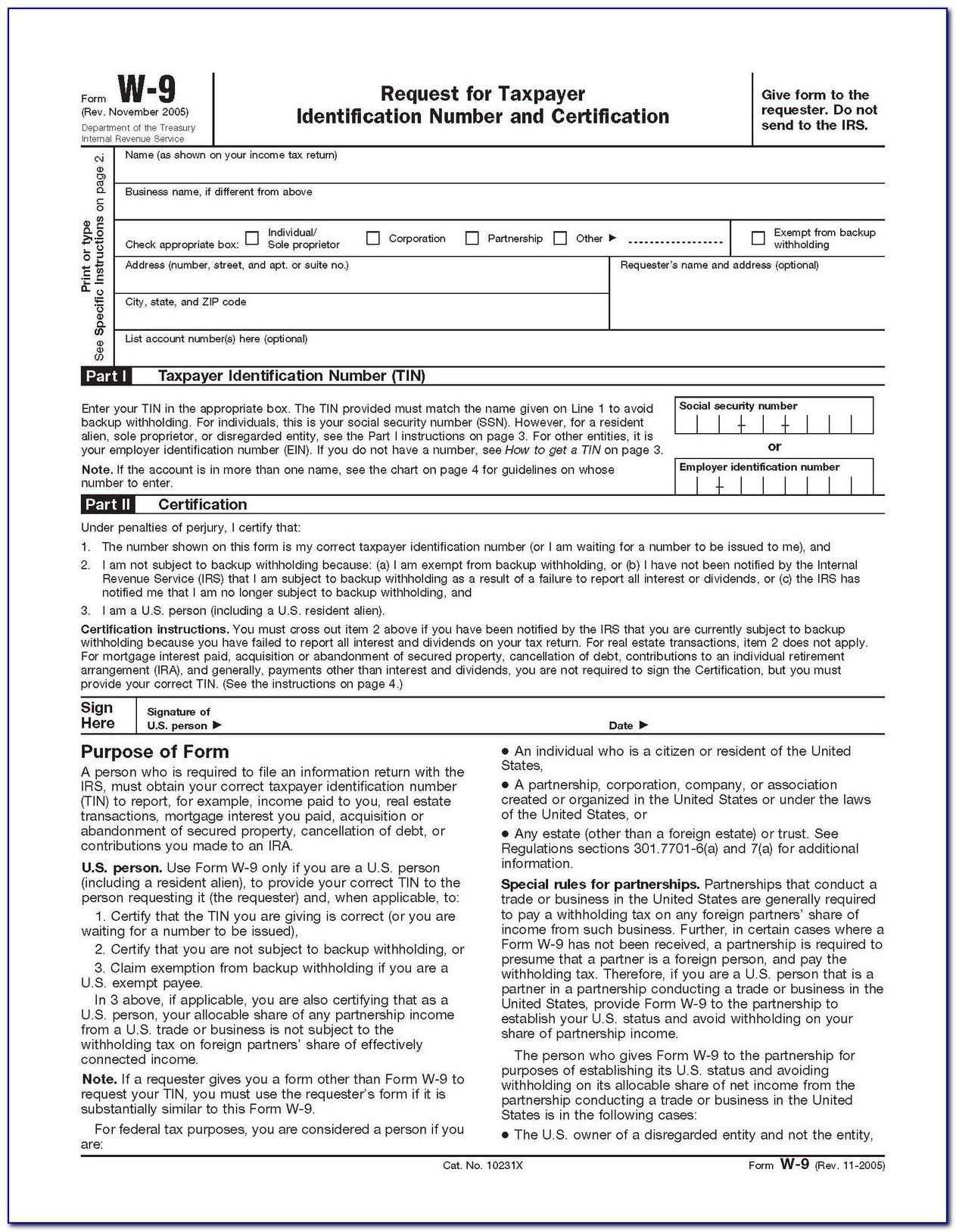

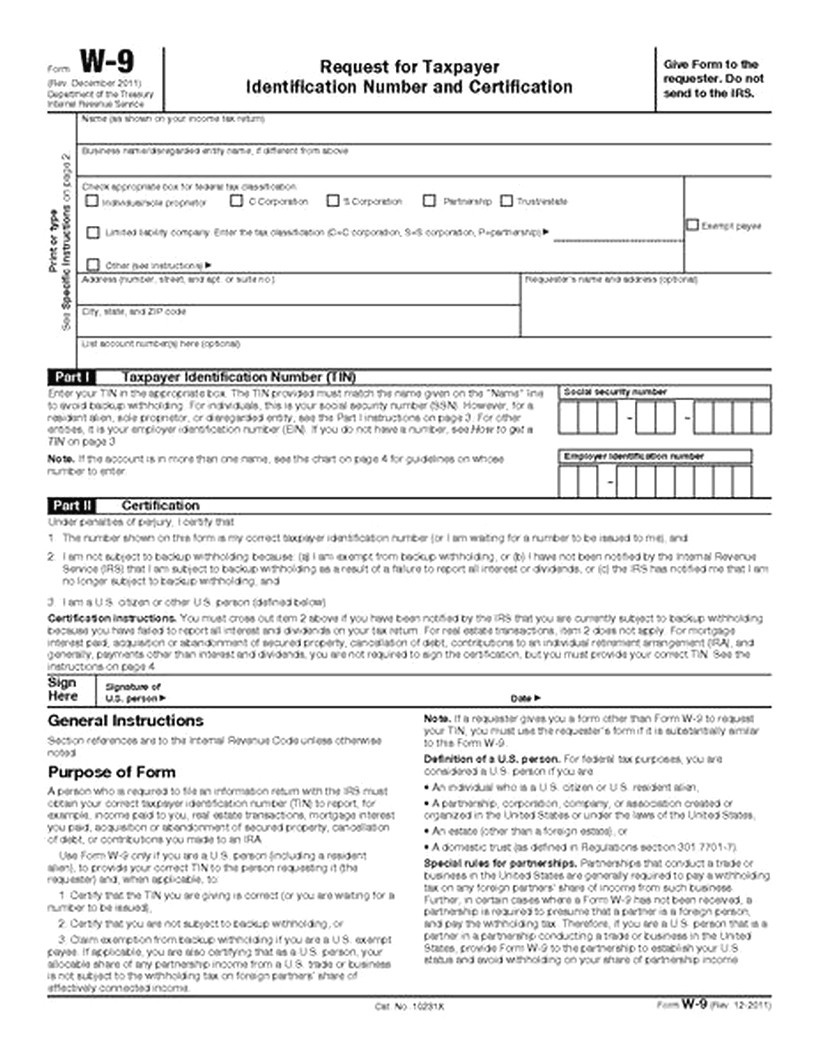

Blank W 9 Forms Printable | Calendar Template Printable

If you receive income as a freelancer, independent contractor, or self-employed individual, you may be asked to complete a W-9 form by your clients or business partners. The form collects important information such as your name, address, and taxpayer identification number (either your Social Security Number or Employer Identification Number).

If you receive income as a freelancer, independent contractor, or self-employed individual, you may be asked to complete a W-9 form by your clients or business partners. The form collects important information such as your name, address, and taxpayer identification number (either your Social Security Number or Employer Identification Number).

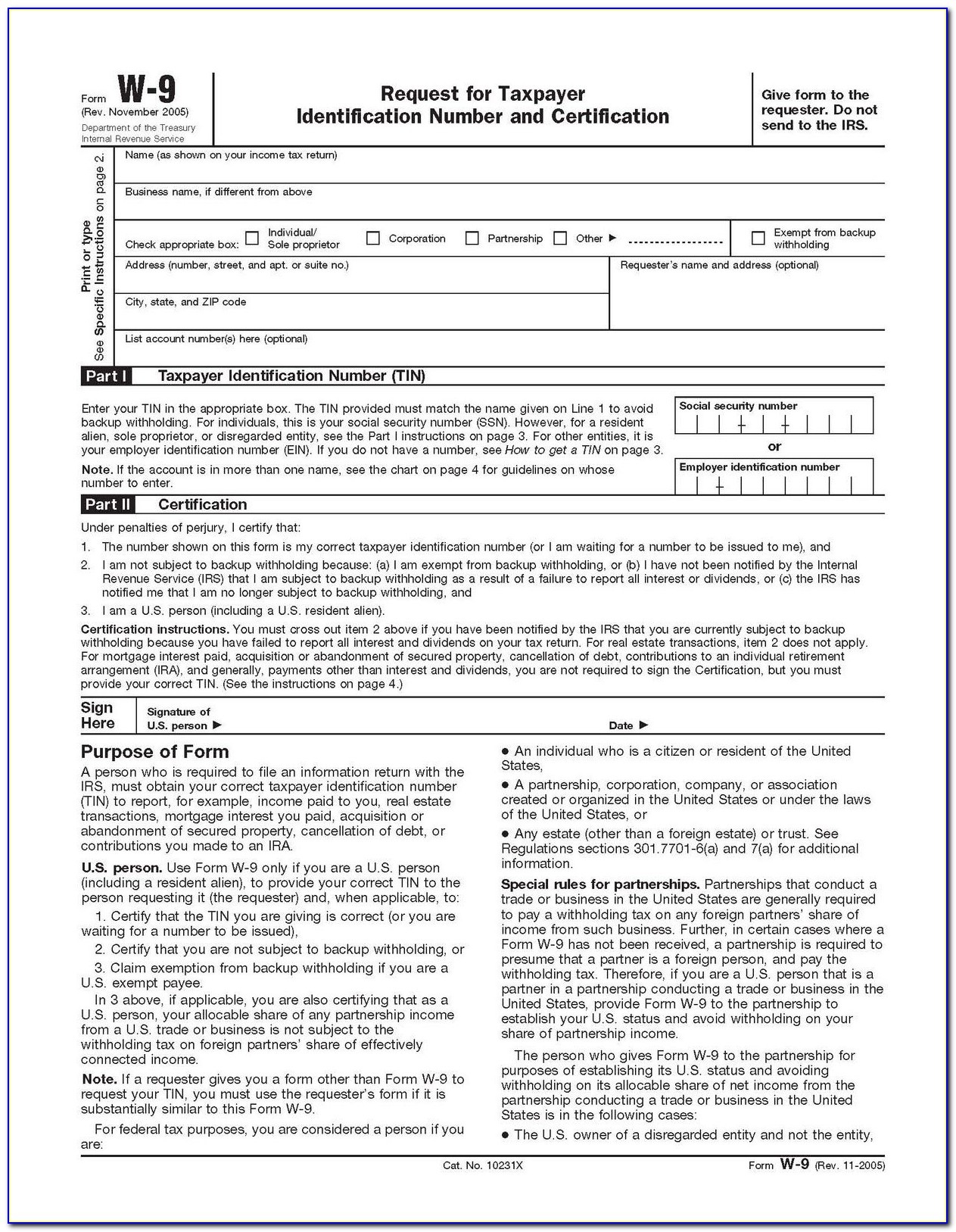

Free Printable W 9 - Free Printable

Obtaining a W-9 form is relatively simple, as it can be downloaded for free from the IRS website or various other online sources. Make sure to provide accurate and up-to-date information on the form to avoid potential issues with tax reporting and compliance.

Obtaining a W-9 form is relatively simple, as it can be downloaded for free from the IRS website or various other online sources. Make sure to provide accurate and up-to-date information on the form to avoid potential issues with tax reporting and compliance.

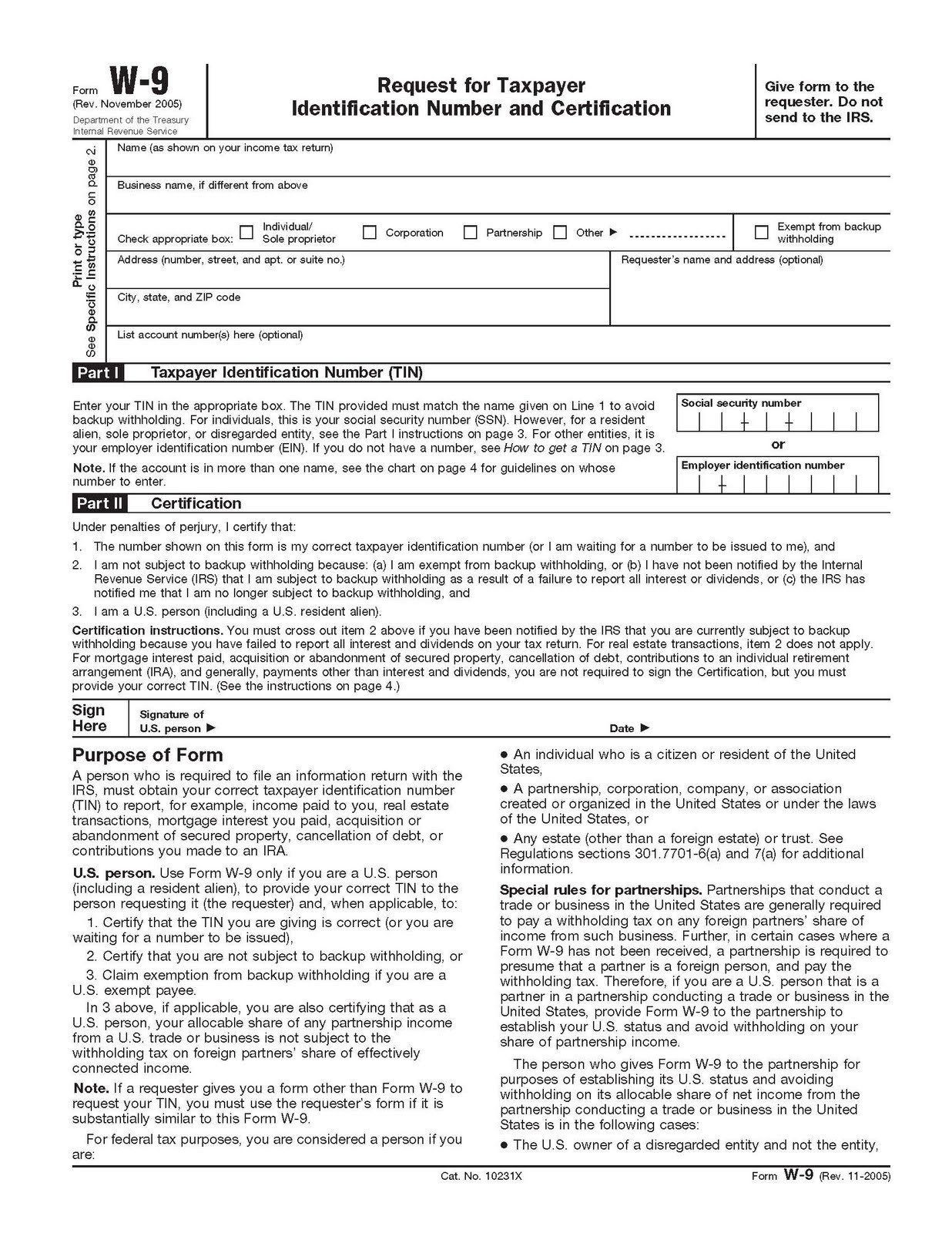

Free Printable Blank W-9 Form 2021 | Calendar Template Printable

It is important to keep in mind that the W-9 form is not submitted to the IRS. Instead, you provide it to the requesting party, such as your client or business partner. They use the information provided on the form to prepare the necessary tax documents, such as Form 1099-MISC, which reports the income they paid you.

It is important to keep in mind that the W-9 form is not submitted to the IRS. Instead, you provide it to the requesting party, such as your client or business partner. They use the information provided on the form to prepare the necessary tax documents, such as Form 1099-MISC, which reports the income they paid you.

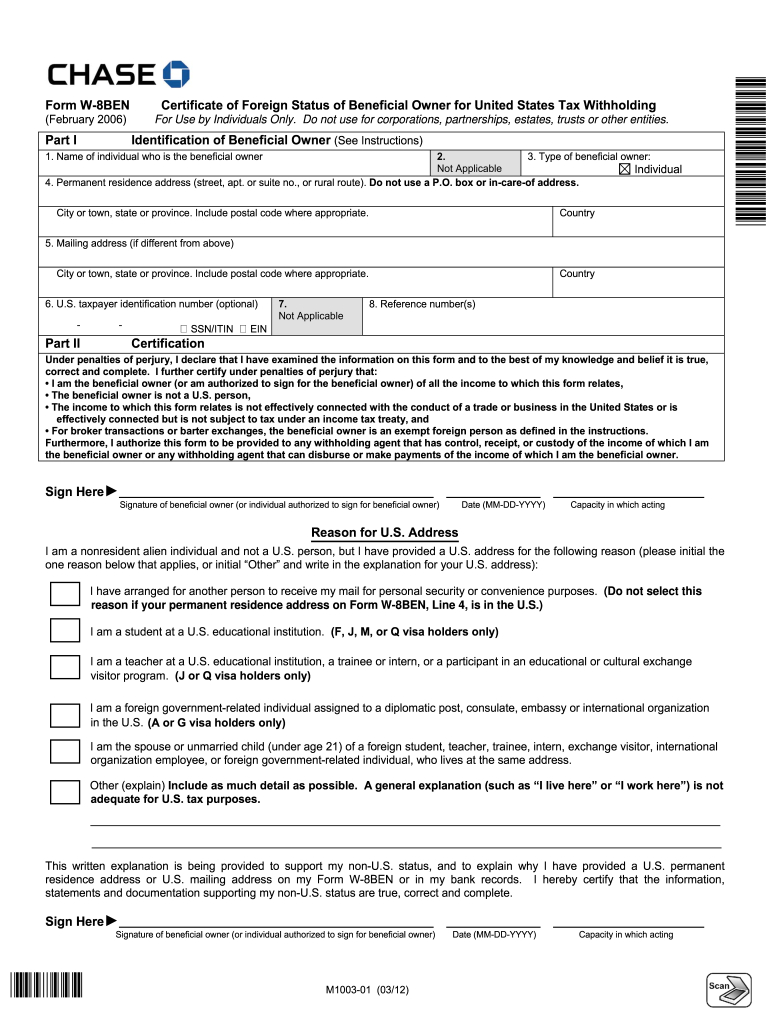

1998 Form IRS W-8BEN Fill Online, Printable, Fillable, Blank - PDFfiller

For non-resident aliens or foreign entities, the W-8 form is essential. This form allows you to claim a reduced rate or exemption from withholding tax on certain types of income. By completing and submitting the W-8 form, you provide the necessary documentation to prove your eligibility for the claimed benefits.

For non-resident aliens or foreign entities, the W-8 form is essential. This form allows you to claim a reduced rate or exemption from withholding tax on certain types of income. By completing and submitting the W-8 form, you provide the necessary documentation to prove your eligibility for the claimed benefits.

Irs Form W8 Printable | Example Calendar Printable

It is crucial to accurately fill out IRS tax forms like the W-8 form. Any errors or omissions may result in delays in processing or even penalties. Therefore, it is advised to carefully review the form’s instructions and consult with a tax professional if needed.

It is crucial to accurately fill out IRS tax forms like the W-8 form. Any errors or omissions may result in delays in processing or even penalties. Therefore, it is advised to carefully review the form’s instructions and consult with a tax professional if needed.

Blank W9 2018 – 2019 – Free W9-Form To Print - W9 Form Printable 2017

Always remember to keep copies of the completed forms for your records. This documentation will be useful in case of an audit or if any discrepancies arise in the future. Maintaining accurate and organized tax records is crucial for proper tax compliance.

Always remember to keep copies of the completed forms for your records. This documentation will be useful in case of an audit or if any discrepancies arise in the future. Maintaining accurate and organized tax records is crucial for proper tax compliance.

W-8 Forms Definition

:max_bytes(150000):strip_icc()/W-8EXP-1-2ca6feb477d840d381382d8a8dcb5f12.png) Understanding the different IRS tax forms is essential for fulfilling your tax obligations. Whether you are a U.S. citizen, resident alien, non-resident alien, or foreign entity, there is a specific form designed to address your tax situation.

Understanding the different IRS tax forms is essential for fulfilling your tax obligations. Whether you are a U.S. citizen, resident alien, non-resident alien, or foreign entity, there is a specific form designed to address your tax situation.

Irs Form W8 Printable | Example Calendar Printable

When in doubt, it is always recommended to consult with a tax professional or seek guidance from the IRS. Tax laws and regulations can be complex, and it is important to ensure that you are in compliance to avoid any penalties or issues with your tax filings.

When in doubt, it is always recommended to consult with a tax professional or seek guidance from the IRS. Tax laws and regulations can be complex, and it is important to ensure that you are in compliance to avoid any penalties or issues with your tax filings.

Remember, understanding and completing the necessary IRS forms accurately is key to maintaining good tax compliance and fulfilling your tax obligations. Make sure to stay informed about any updates or changes in tax regulations to ensure you are on the right track.