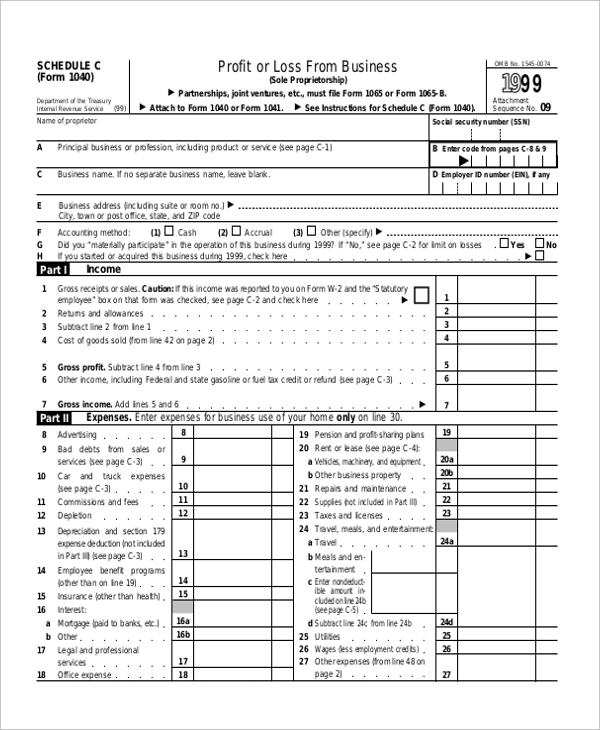

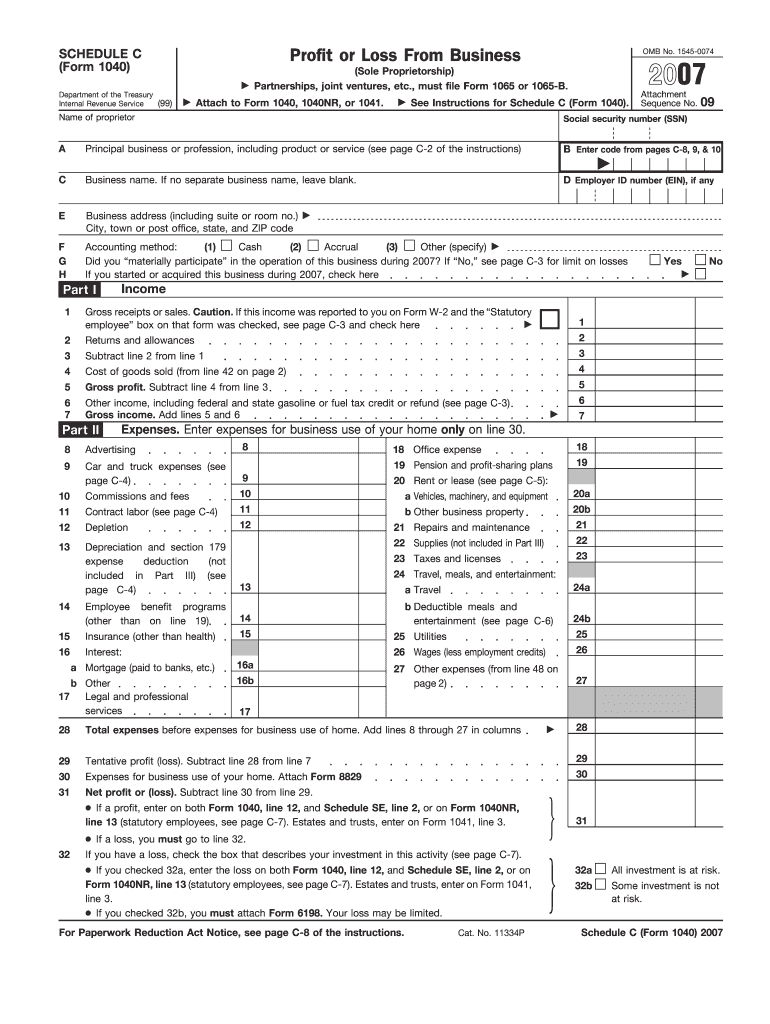

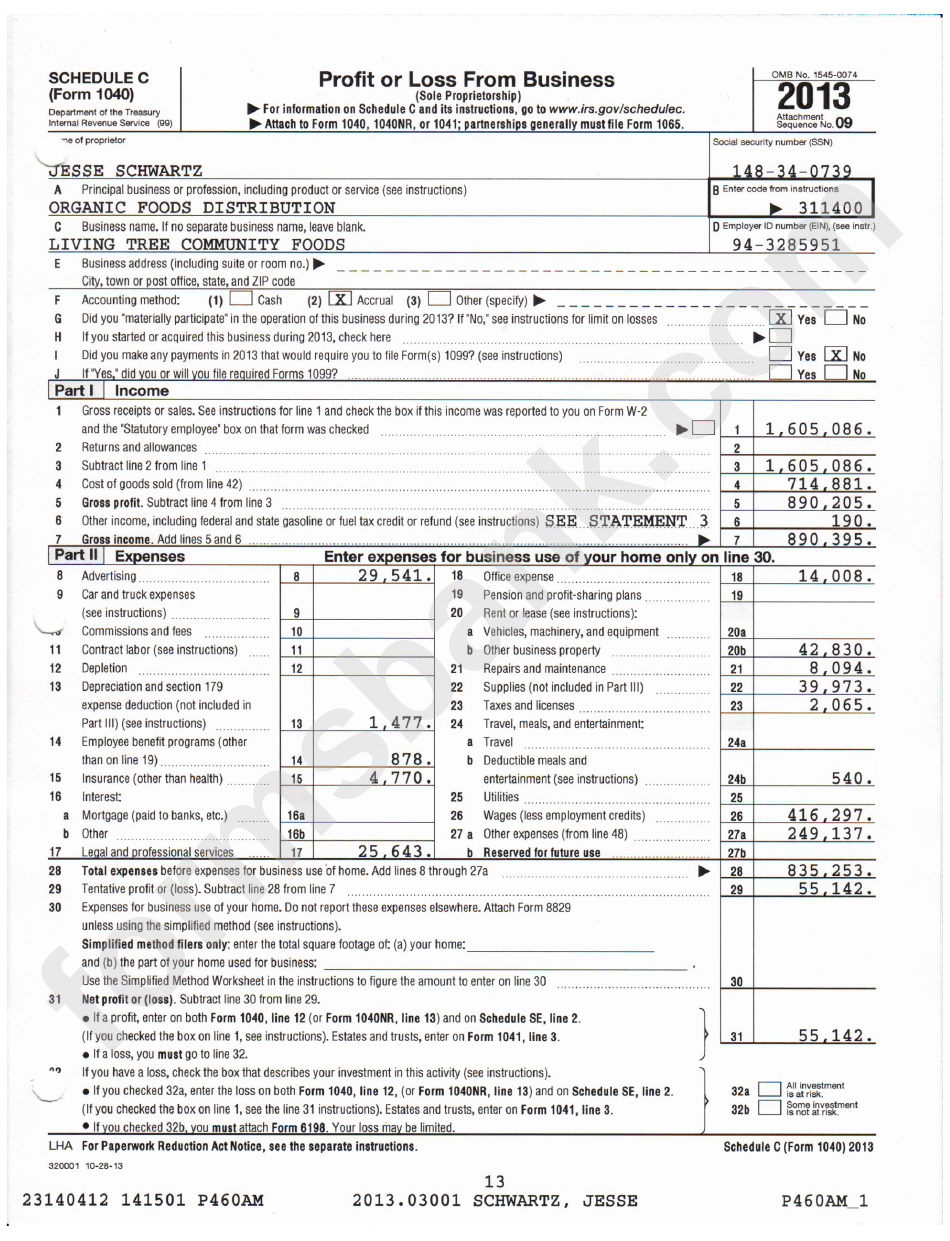

When it comes to tax forms, one that often causes confusion is Schedule C. This form is used by self-employed individuals to report their business income and expenses. If you’re unsure about how to fill out Schedule C, don’t worry - we’re here to help! In this post, we’ll provide step-by-step instructions to help you navigate this important form.

Step 1: Gather Your Information

Before you begin filling out Schedule C, make sure you have all the necessary information at hand. This includes your business income and expenses, as well as any supporting documentation such as receipts and invoices. Being organized will make the process much smoother.

Before you begin filling out Schedule C, make sure you have all the necessary information at hand. This includes your business income and expenses, as well as any supporting documentation such as receipts and invoices. Being organized will make the process much smoother.

Step 2: Complete Part I - Income

In Part I of Schedule C, you’ll report your business income. This includes any money you earned from your self-employment activities. Make sure to accurately report all sources of income, including any income that may not have been reported on a 1099 form.

In Part I of Schedule C, you’ll report your business income. This includes any money you earned from your self-employment activities. Make sure to accurately report all sources of income, including any income that may not have been reported on a 1099 form.

Step 3: Deduct Your Expenses

Part II of Schedule C is where you’ll deduct your business expenses. This includes any expenses that are necessary for your business operations, such as supplies, advertising, and travel expenses. Make sure to keep accurate records and receipts to support your deductions.

Part II of Schedule C is where you’ll deduct your business expenses. This includes any expenses that are necessary for your business operations, such as supplies, advertising, and travel expenses. Make sure to keep accurate records and receipts to support your deductions.

Step 4: Calculate Your Net Profit or Loss

In Part III of Schedule C, you’ll calculate your net profit or loss. This is done by subtracting your total expenses from your total income. If you have a profit, you’ll carry this amount over to your Form 1040. If you have a loss, you may be able to deduct it from other sources of income.

In Part III of Schedule C, you’ll calculate your net profit or loss. This is done by subtracting your total expenses from your total income. If you have a profit, you’ll carry this amount over to your Form 1040. If you have a loss, you may be able to deduct it from other sources of income.

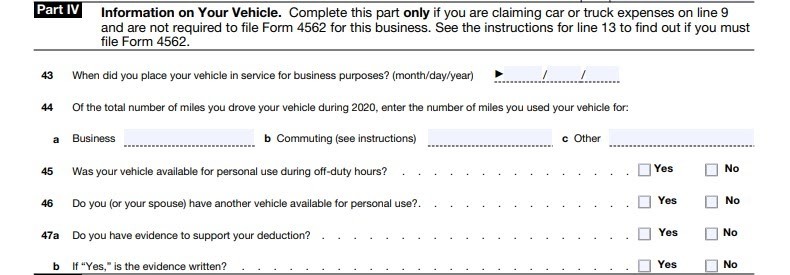

Step 5: Additional Information

Part IV of Schedule C is where you’ll provide additional information about your business. This includes details about your business type, whether you have employees, and if you use your home for business purposes. Make sure to accurately complete this section to avoid any potential issues.

Part IV of Schedule C is where you’ll provide additional information about your business. This includes details about your business type, whether you have employees, and if you use your home for business purposes. Make sure to accurately complete this section to avoid any potential issues.

Filling out Schedule C correctly is crucial for self-employed individuals. It ensures that you accurately report your business income and expenses, while taking advantage of any deductions you may be eligible for. By following these step-by-step instructions, you can navigate Schedule C with ease and confidence.

Remember, it’s always a good idea to consult with a tax professional or use tax software to ensure that you’re filling out Schedule C correctly. They can provide guidance specific to your situation and help you maximize your deductions. With the right tools and knowledge, you’ll be well-equipped to handle Schedule C and stay on top of your self-employment taxes.