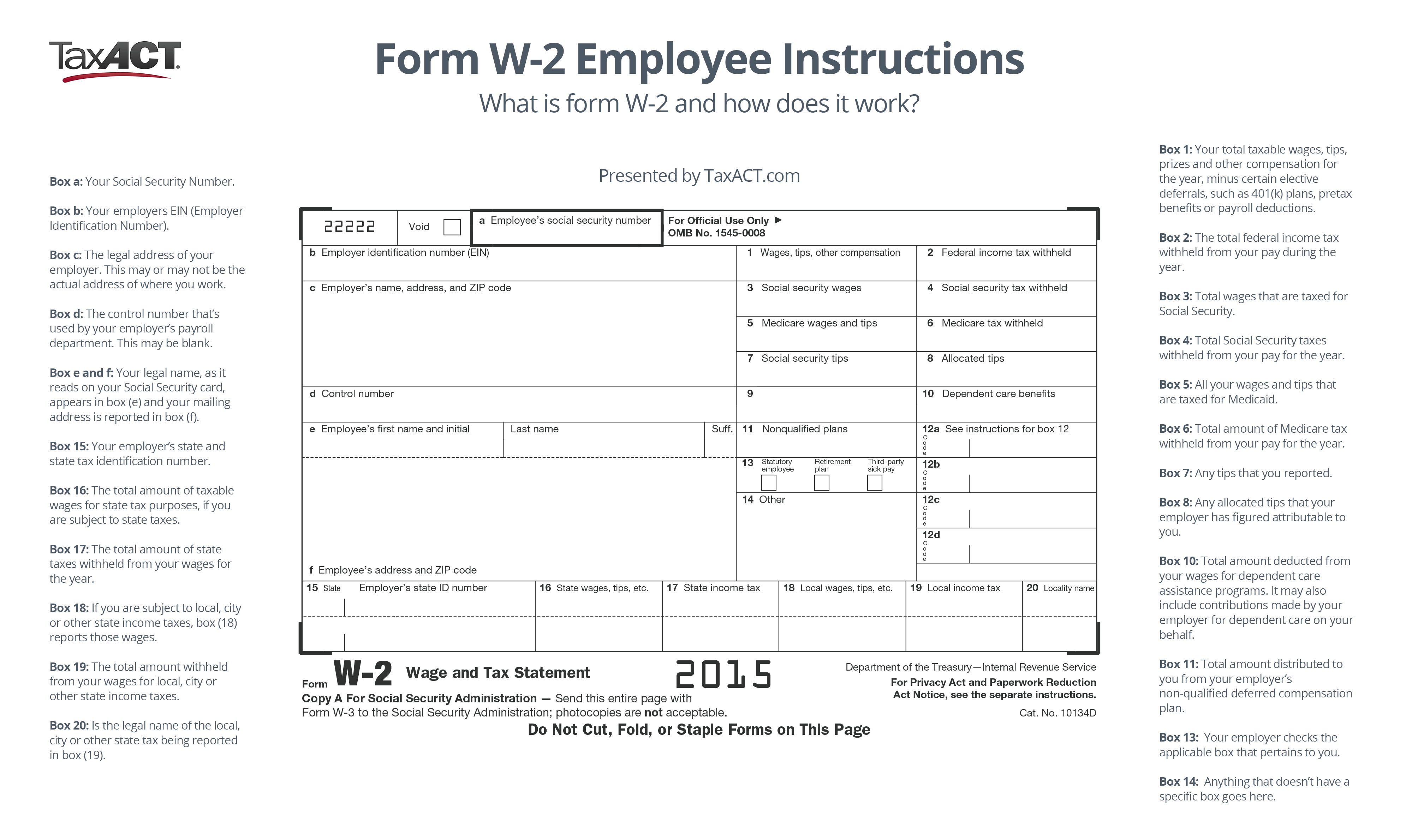

Form W-2 is an important document that is used to report an employee’s annual wages and the amount of taxes withheld from their paycheck. For many individuals, this form plays a significant role in their tax filing process. It provides essential information that helps the Internal Revenue Service (IRS) determine an individual’s tax liability.

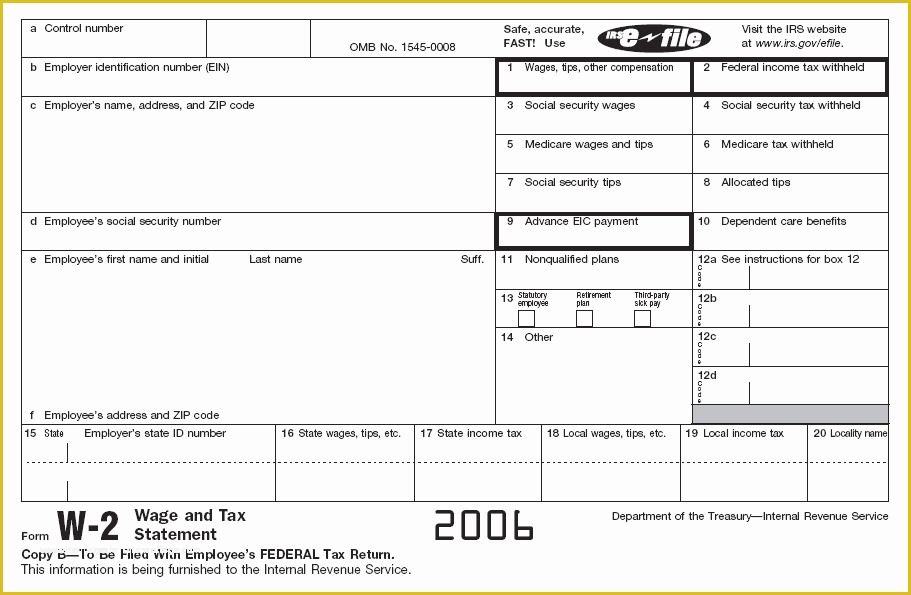

W2 Form Template

W2 Form Template

One of the common reasons people search for W2 forms is to find a template that they can use as a reference. Having a template can simplify the process of filling out the form, especially for those who are unsure about the required information. A W2 form template typically includes all the necessary fields such as the employer’s name and address, employee’s personal information, wages, and tax withholdings. By using a template, individuals can ensure that they include all the required details accurately.

Understanding Box 14 on Form W-2

Understanding Box 14 on Form W-2

When reviewing their W2 form, employees may come across Box 14, which often contains additional information provided by their employer. This box is optional, and employers may use it to report various types of compensation or deductions, such as contributions to a retirement plan, union dues, educational assistance, or taxable fringe benefits. It is important for employees to understand the content of Box 14 to accurately assess their income and deductions while filing their taxes.

Free W2 Template for Easy Tax Filing

Free W2 Template for Easy Tax Filing

With tax season around the corner, many individuals search for a free W2 template to help them prepare and file their taxes. A free W2 template eliminates the need for manual calculation and ensures that all necessary information is entered correctly. This can save individuals time and reduce the likelihood of making errors, making the process of filing taxes much smoother and hassle-free.

Convenient Online Download: W2 Form 2018 PDF

Convenient Online Download: W2 Form 2018 PDF

For individuals who prefer digital copies of their W2 form, there are options available for online download. An online platform allows users to access their W2 form conveniently and securely. By downloading the W2 form in PDF format, individuals can keep a digital copy for their records and easily share it with their tax preparer or accountant.

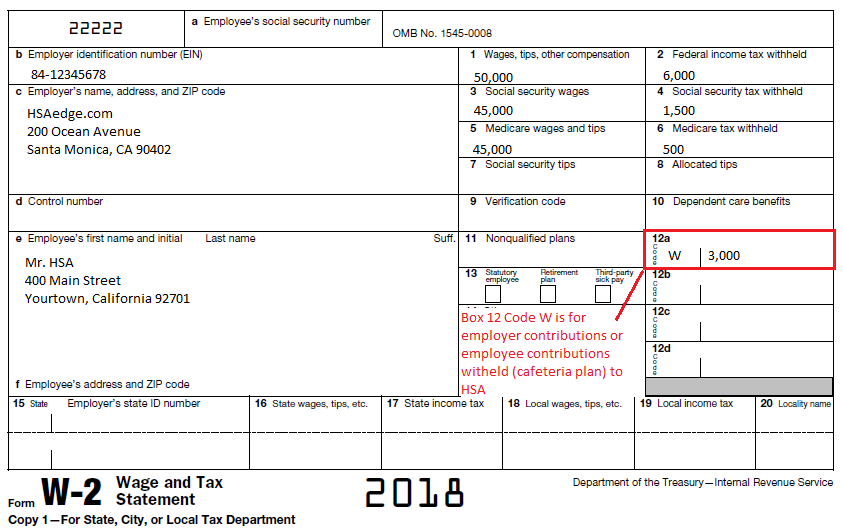

Understanding HSA Employer Contributions on W2

Understanding HSA Employer Contributions on W2

Health Savings Accounts (HSAs) have become a popular way for individuals to save money for medical expenses while reducing their taxable income. If an employer contributes to an employee’s HSA, this contribution is typically reported on the employee’s W2 form in Box 12 with the code “W.” Understanding this information is crucial as it can affect an individual’s tax liability and deductions related to HSAs.

Employer W2 Form Deadline

Employer W2 Form Deadline

It is important for both employers and employees to be aware of the deadline for filing W2 forms. Employers must provide their employees with their W2 forms by the end of January each year. Employees should ensure that they receive their W2 forms on time to avoid delays in preparing and filing their tax returns. It is recommended to communicate with employers and address any concerns promptly to ensure compliance with tax regulations.

Convenience of Printable W2 Forms for Employees

Convenience of Printable W2 Forms for Employees

Printable W2 forms offer convenience and flexibility for employees. By having access to printable forms, employees can easily obtain copies of their W2 form without relying on their employers. This can be particularly useful for individuals who have changed jobs or need multiple copies of their W2 form for different purposes, such as applying for loans or scholarships.

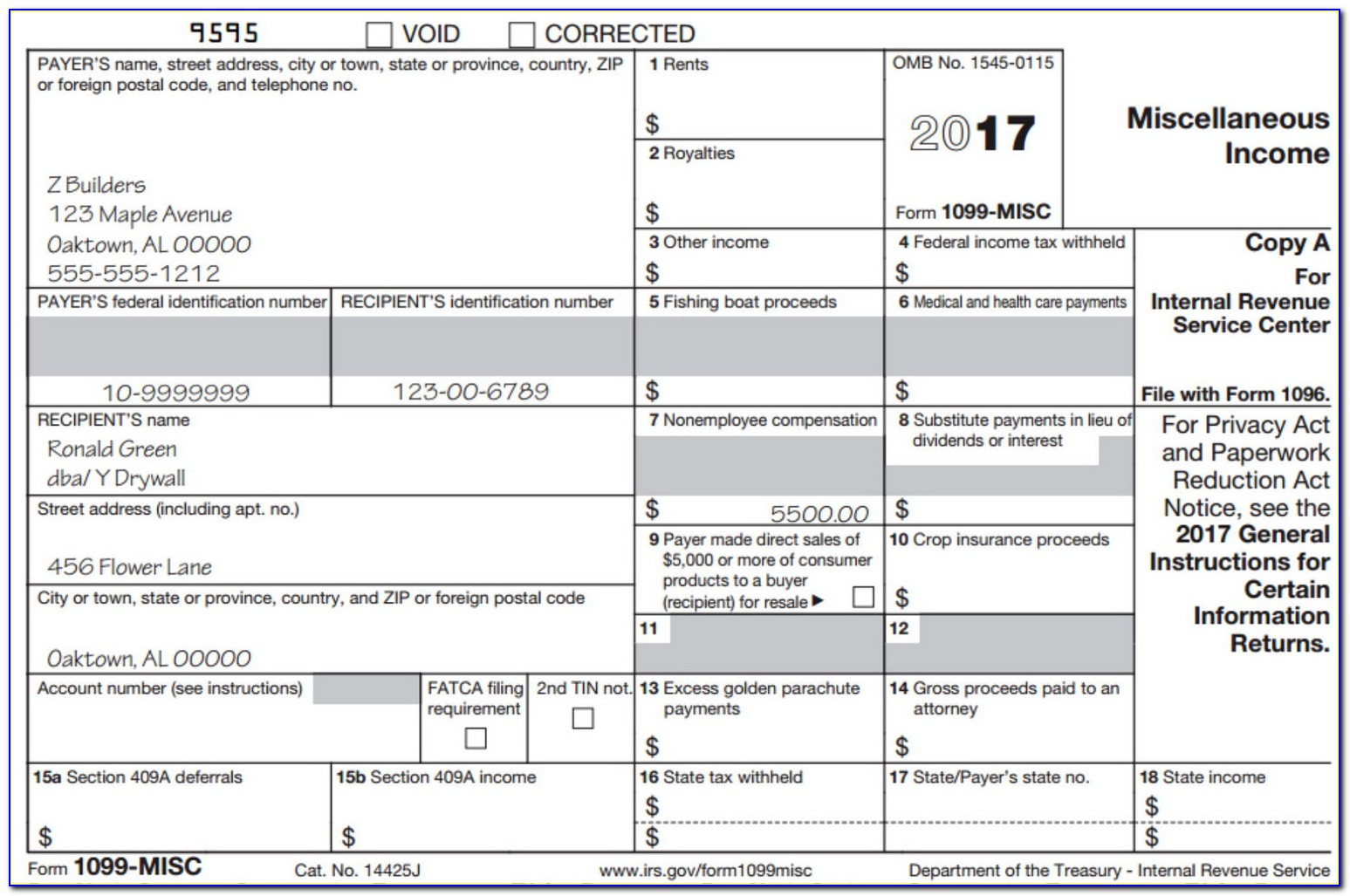

Evolving W2 Forms: Changes Over the Years

Evolving W2 Forms: Changes Over the Years

The format and design of W2 forms have evolved over the years, with updates to ensure compliance with changing tax regulations. In 2013, for example, several changes were made to the W2 form, including the addition of new codes to report the cost of employer-sponsored health coverage. Staying informed about these changes is essential to accurately complete and file the W2 form each year.

Employer W2 Form and its Importance

Employer W2 Form and its Importance

For employers, the W2 form plays a crucial role in their payroll processes. It provides a comprehensive summary of each employee’s wages, tips, and other compensation, as well as the taxes withheld throughout the year. By accurately completing and filing W2 forms, employers demonstrate their commitment to fulfilling their tax responsibilities and ensuring that their employees receive the necessary documents to file their taxes.

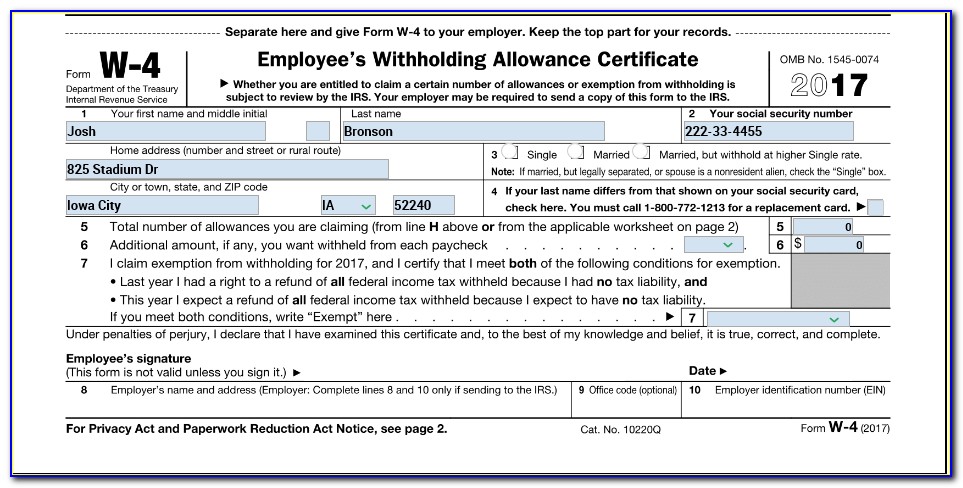

Understanding Form W-2 and Its Instructions

Understanding Form W-2 and Its Instructions

To understand how to properly complete and utilize the W2 form, employees can refer to the accompanying instructions and guidelines provided by the IRS. Form W-2 instructions offer detailed explanations of each box on the form, ensuring that individuals can accurately report their income and deductions. Familiarizing oneself with this information can help employees navigate the tax filing process with confidence.

In conclusion, the W2 form is a critical document that impacts both employees and employers. It serves as the gateway to accurately reporting income and fulfilling tax obligations. By understanding its components, utilizing templates, and staying informed about any changes, individuals can effectively navigate the tax filing process and ensure compliance with tax regulations.